How AI Will Fuel Next-Gen Merchandising Decision Support Systems

Category Management Hierarchical Evolution

Aligning assortment merchandising strategies with consumer purchase behavior and responding to change in a timely manner has been the holy grail of the category management industry for many years. At the same time, traditional merchandising solutions have remained relatively unchanged since the 1980s, putting more pressure on the existing solutions and the human decision-making process. However, current solutions and processes rely on outdated industry conventions and human constructs or assumptions. They also can not process ever-growing datasets and merchandising rules. Translating outside assortment/category trends and insights into tangible, value add business action is extremely difficult. This, in turn, makes trend analysis, category assessment, assortment optimization, planogram development, and optimizing the shopper's experience at any retail store simply impossible tasks. It's why most retailers and CPGs (Consumer Packaged Goods) focus on averages of averages or assortment planning at the cluster level.

However, next Generations (NextGen) merchandising solutions aim to make category management more effective by using the wealth of datasets available today with sophisticated machine learning algorithms to drive merchandising decisions to a precision not possible with current offerings. They essentially combine the tasks of assortment analysis, category assessment, assortment optimization, and planogram development into one so category managers can focus on what humans are good at; being more strategic, rapid, and transparent in their assortment decisions with retailers.

These NextGen solutions are essentially augmenting assortment strategies and market actions with transparency. We are moving from an era of merchandising solutions that were good at “planning” and “automation” to one now focused on the “augmentation” of human decision-making. Providing a new level of competitive advantage. This is where we, as an industry, are heading and where HIVERY and HIVERY Curate are focused. We are creating this new "solution space" for the next generation of category management professionals; essentially, the ability to maximize assortment profitability at the push of a button.

Embracing these NextGen merchandising solutions can help retailers and CPGs companies move from fixed seasonal merchandising plans to more fluid planning that responds to consumer interests and needs. Not all consumer trends are predictable, and modern merchandising augmentation systems empower retailers to respond to short-term surges or drops in demand for certain products. With these tools, retailers are more in charge of category management than ever before.

From Planning to Automation

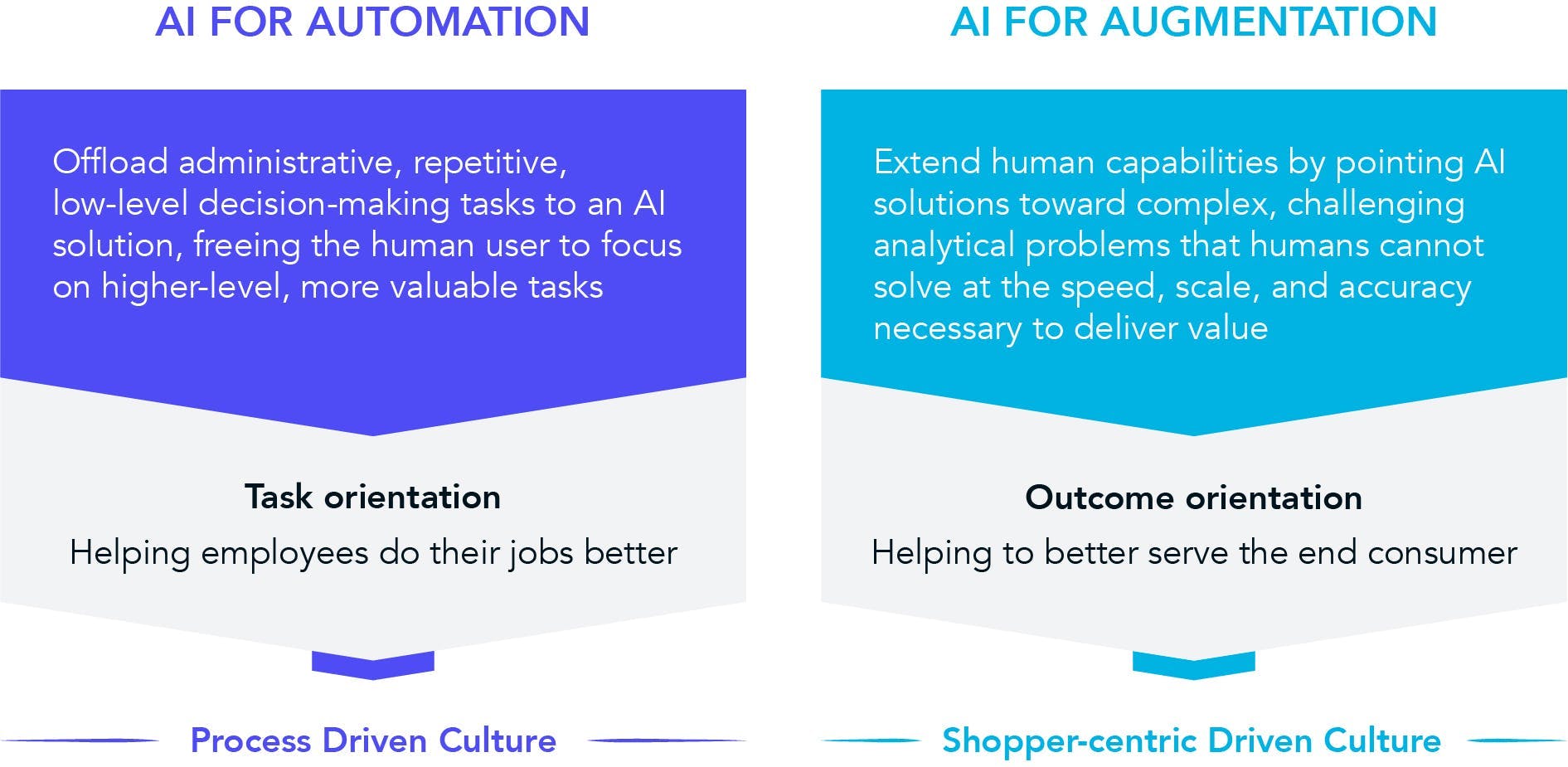

The first step in the evolution of category management was simple process improvement through increasing automation. First-gen AI solutions allowed retailers to automate many aspects of merchandising planning. These solutions saved retailers time, but the insights those AI solutions were working on were too limited to offer significant value.

Today's merchandising processes

- Are inefficient and labor-intensive

- Use tools that require specialist expertise

- Are limited in scope and don't share data effectively

- Use siloed processes that make it hard for teams to work together

These challenges mean retailers can't collaborate effectively, and store-specific merchandising planning is difficult.

From Automation to Augmentation

In the last few years, category management has truly evolved, and we've entered the era of “NextGen” AI-driven solutions that can truly augment our decisions around SKU rationalization, SKU innovation, and localized space planning.

With these tools, assortment strategy and execution are inextricably linked. Modern retailers & CPGs need fast, efficient, and customer-focused solutions that can operate at scale. With NextGen solutions, the upstream and downstream can communicate, making omnichannel marketing more efficient. SKU Introduction, rationalization, and optimization become more practical.

NextGen solutions use more sophisticated machine learning algorithms that can consider category goals (i.e., volume vs sales) as well as merchandising constraints and rules to help augment merchandising decisions and quantify that strategy. Rather than merely offloading repetitive tasks, augmentation builds on existing human skills and capabilities.

In this ebook, we’ll examine the various challenges merchandisers face today and how to mitigate them using next-gen merchandising solutions that are a step up from the traditional planning-centric approach.

Why Assortment Planning Will Get Harder and Harder

Assortment planning effectively has always been challenging, but today's retailers face even stronger challenges than the previous generation. Traditional assortment planning techniques are no longer enough to help vendors cope with the challenges that retailers face today. Some of the challenges retailers and CPG face include the following:

Space Constraints

In many areas, the quantity and variety of assortment planning outcomes depend on space limitations. The rise of small-format stores means CPG companies must make strategic decisions about which merchandise to sell at different venues. CPG, with a large inventory of products, may lose out on sales if they make the wrong decisions when choosing inventory at a localized level.

The Growth of In-Store Services and Omni-Channel Experiences

In-store services are becoming increasingly common. Grocery stores, pet stores, drug stores, etc., are finding the space available for merchandising is being encroached upon by these extra offerings. The reduced shelf space reduction means retailers must be more selective in their assortment planning. Just as in-store services eat into retail space, so do omnichannel experiences. When retailers carve out space for curbside pickup, this decreases the space available for products.

Increasing Use of Online Shopping

Assortment planners also need to consider how and where people shop. During the pandemic, consumers made around 75% of their retail purchases online. While that figure has fallen recently, online shopping is still more common than in 2019. An important part of assortment planning is deciding which products to hold in a warehouse and which to give that limited retail space to.

Supply Chain Delays

One of the lasting economic consequences of the pandemic is supply chain problems. Assortment planning is difficult enough without delayed deliveries, unpredictable consumer demand, and the challenges this creates for managing stock levels. The traditional "just-in-time supply chain" falls apart when products are stuck in shipping containers for weeks. These delays can be particularly challenging for vendors who rely on seasonal footfall for the bulk of their profits.

To cope with these challenges, retailers must change their category management and merchandising optimization approach. Using NextGen solutions, assortment planners can factor various constraints into the model to simulate the impact. This helps them decide better which products to focus on and adjust execution plans accordingly. The difference here is NextGen solutions provide this simulation rapidly and with no data scientist or analytical expertise involved in the process. NextGen solutions put the power back into the hands of operations folks like senior buyers, merchandising directors, sales and marketing, and category management teams.

Merchandising, buyers', and category managers’ jobs are likely to get harder over the coming months and years. Both merchants and category managers are facing competing pressures. The combination of these constraints leads to merchandise that falls short of shoppers' need for relevant assortment planning at a local level. To improve outcomes for retailers and CPGs companies, merchandising and category managers must change how they work.

Let’s watch this video to learn more about why this job is getting harder:

Why Merchandising and Category Managers' Jobs Will Get Harder

Let's consider some of the challenges these managers face:

Increased Space Constraints

As discussed in the previous chapter, space constraints can be problematic for merchandisers and category managers. How do these managers decide how to fill their limited retail spaces? Will any of these decisions drive customers away?

Operational Challenges

Operational challenges come in many forms, including supply chain issues, the threat of lockdowns or social distancing measures, and even staffing challenges. While not all of these issues directly involve products, they can still be relevant to the issue of merchandising and category management. Retailers should be proactive in reducing these challenges' impact on category management.

Rapidly Changing Shopping Behaviors

Shoppers are behaving differently today than they did just two years ago. The pandemic has accelerated many changes in shopping habits, such as the use of online retailers. Category managers must consider whether there may be other changes, such as increasing usage of click-and-collect or a shift towards using subscription services for consumables. Changing consumer behavior requires careful attention to category management planning and automation.

Forecasting Hurdles

The pandemic isn't something that retailers could have easily predicted, nor could retailers have accurately forecast the economic fallout from lockdowns. However, retailers do need to attempt to forecast the hurdles they may face in the coming months or years. Forecasting obstacles historically meant focusing on some narrow issues. Still, today retailers need to take a broader view, considering problems with the supply chain or other issues that could seriously affect category management augmentation.

SKU Rationalization

SKU rationalization is a simple form of evaluation where retailers consider whether carrying certain SKUs is worthwhile. What existing SKUs to keep? What to delete? What space to allocate? What is the impact of demand transference?

SKU Innovation

There could be opportunities that retailers are taking advantage of. SKU innovation involves asking: what are my competitors selling that I could be but am not? How does the team make space for SKU innovation? Where will the demand transfer if we add this new SKU innovation? How can we evaluate these new SKUs' impact before executing in stores?

New Product Development

Merchandising and category management professionals may also be missing out on other opportunities, such as assessing their stores’ white space. What new product could fill that space? And, what’s the evaluation process to identify those potential products? Failing to identify potentially useful new products is another area where retailers may leave money on the table.

Localization at the Store Level

Finally, these constraints affect decisions about what products to sell at which location. Traditional systems were good at identifying demand across chains but not at a local level. Both merchandisers and category managers face localization challenges.

Why Current Assortment Planning And Optimization Approaches Are Broken

Given the constraints in the assortment planning and retail sphere today, it’s not surprising that assortment planning and optimization approaches are largely broken. The constraints are created and implemented in assortment planning to ensure safety requirements are met, contractual obligations are adhered to, support promotion efforts, or make it easier for shoppers to find products on the shelf. Constraints in the real assortment planning world can include controlling POD (Points of Distribution) presence or Forcing PODs in or out, and controlling product slotting. Further, they are other more complicated contrails around space, such as specifying DOS (Days of Supply) threshold or limiting space churn. Pre-pandemic, there were numerous stressors on these processes.

Category management and assortment planning need to consider these Constraints to make it “workable” on physical store shelves. Attempting to refine traditional planning would be a waste of time and money. These processes have been broken by:

- Increased datasets

- Increased merchandise rules and contraints

- Rapid changing behaviors (especially in light of the pandemic)

- Increase in alternative purchase channels: online and curbside pickup services

- Acceleration of SKU innovation and, in some cases, new categories eg, plant-based products

But that’s not all; many processes constrain modern retail. Without change, they will continue to be indicative of a broken system. These further constraints include:

- Inefficient and labor-intensive processes

- Specialized tasks require specialized skill sets

- Reduced integration of siloed, separate, and stepwise processes

- Localized, store-specific planning remains largely a pipe dream

- Retailers rely on outdated tools and narrow data to make assortment planning and category management decisions.

- Disconnected data sets throughout the chain limit impactful insights.

What Do Retailers Say?

For the most part, retail buyers, merchandisers, and category management professionals simply up with these constraints, spending days, if not months, getting assortment and space rules right before preparing planograms for execution. Once rules and constraints have been applied to their assortment plans, they must also see how these impact category sales and volume. Collaboration between retailers and consumer package goods suppliers is required to fine-tune assortment strategies, so all parties win. This can also be a lengthy process in reviewing each constraint, impact on sales, and volume needs to be assessed. Transparency and speed are critical to meet commercial and shopper needs. The ability to apply constraints to determine commercial impact is often suboptimal. Both retailers and suppliers use their own “traditional” methods, such as demand forecasting and customer decision trees (CDT) techniques, to gauge insights.

Firstly, 54%* of retailers report improving ecosystem collaboration is their top priority. They know the discordant communication and collaboration situation that underscores their broken system. They believe that making decisions in a more collaborative environment would improve outcomes.

Secondly, 48% of retailers report that a lack of accessible data across the value chain is a top merchandising challenge. These staffers know that they are making decisions with limited data. They find it challenging to make decisions without more information. Frustratingly, better data and more information do exist. But they cannot tap into it. Artificial intelligence, specifically machine learning models, can discover patterns with these datasets and understand assortment and space rules better and faster.

NextGen inherently encompasses these trained machine learning models that can consider any assortment and space constraints in its recommendations and do this rapidly and with transparency, making collaboration between retailers and suppliers more natural, perspective in nature, conversational and effective.

* Source: IDC Global Retail Core Business Processes and Applications 2021 Survey (N=805)

Growing Importance Of Retail And CPG Collaboration

As mentioned in the previous section, a collaboration between Retail and CPG suppliers is critical when making merchandising assortment decisions. Retailers and CPG suppliers do not operate in a bubble. While their focus differs, many of their goals are aligned. How can these entities capitalize on their shared priorities? Collaboration between retailers and CPGs could benefit both sides and help retailers provide customers with the products they want and need.

Shoppers Need Access to the Products They Require

Effective collaboration between retailers and CPG companies means shoppers at what they need at the right time at the right space (store). Because category management is not a cut-and-dry process, collaboration arms retailers and CPGs with the information they need to make better decisions and serve their customers more effectively; we will all agree if the collaboration sessions improve merchandising decisions, shoppers' experience will be better, and customer churn will be reduced.

Fulfilling shoppers’ needs in the modern era requires a coordinated effort from retailers and suppliers. Once retailers identify products to sell, they would do well to communicate with suppliers to create a more resilient supply chain. Today, climate issues and the pandemic have increased the prominence of supply chain problems. These problems are not only global but local too. For instance, many port infrastructures are outdated. Some cities have updated their systems and processes to cope with these issues. With improved collaboration, decisions about where to source goods and how to get them to shelves with no interruptions have become a pressing priority.

It will take retailers and CPG suppliers working together to eliminate many supply chain issues and insulate themselves from further catastrophic disruptions. Many shoppers have seen that entire aisles at their favorite stores remain empty of products. While these problems may have appeared for the first time on a large scale due to the pandemic, they can also occur for other reasons. Hurricanes and other natural disasters are becoming increasingly common and threaten global supply chains. The need for collaboration is pressing. The impetus to connect is there, but how can this be done? Collaboration requires a process for these entities to communicate consistently to achieve their shared goals.

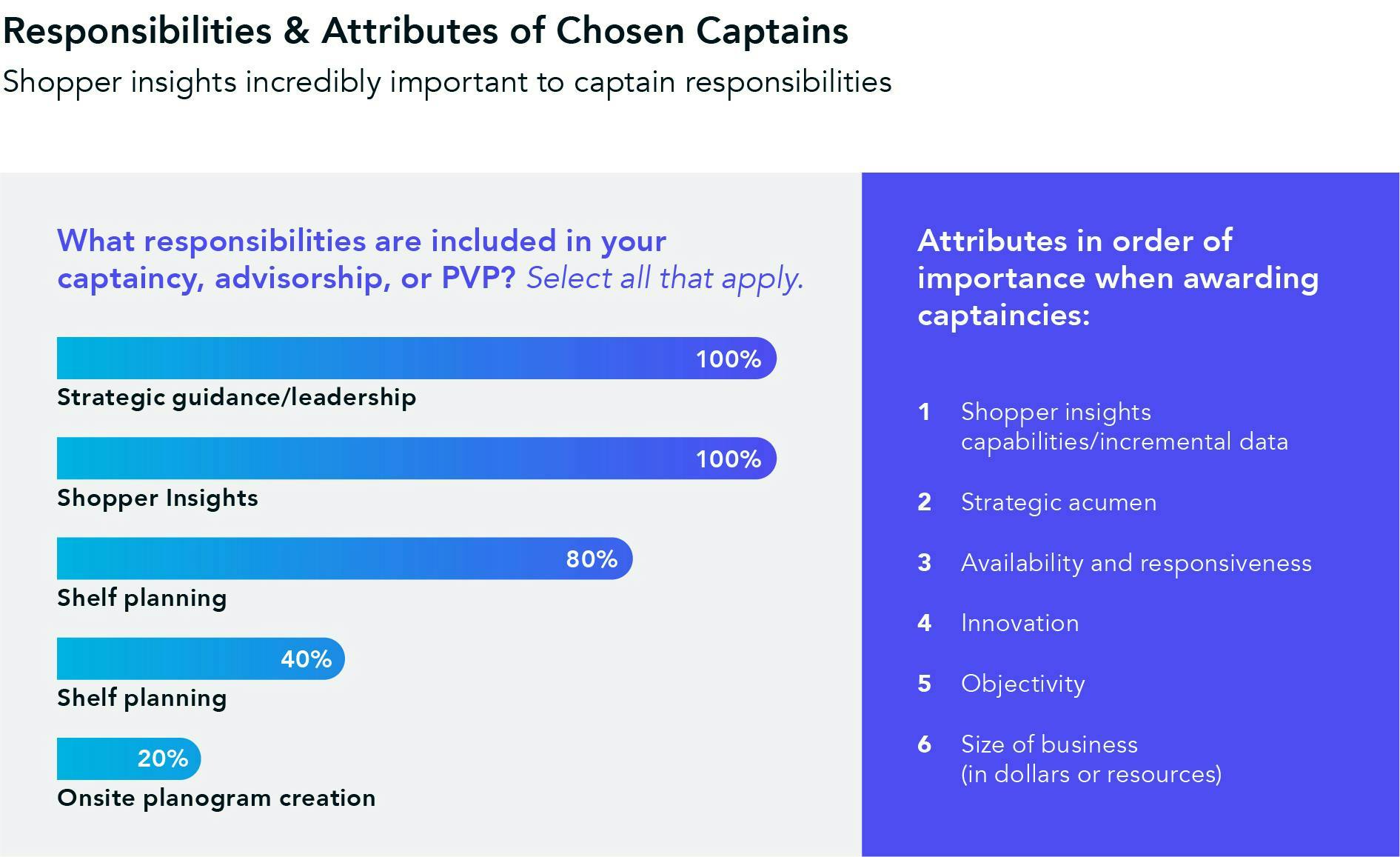

A 2021 Category Management Association survey revealed that strategic guidance/leadership and shopper insights are key attributes sought by retailers.

Further, having strategic acumen and being available and responsive are key attributes awarded for captaincies. But offering strategic insight on assortment and being responsive and transparent can only be achieved if recommendations consider assortment and space rules and constraints and the impact of demand transference and cannibalization. Put, retail & CPG collaboration on assortment and merchandising boils down to being strategic, rapid & transparent.

How AI Will Augment Retail And CPG Collaboration

Retailers are starting to acknowledge that AI is a powerful and useful tool. AI augmentation is the key to developing a collaborative environment between the retail and CPG communities. In the last two years, AI has gone from being seen as a visionary concept to something for which the retail industry can see practical use. These parties are aware that the technology exists--and they want it. They want the tools and associated processes needed to leverage them for success. They are aware that AI augmentation will positively affect:

Supply Chain Operations and Management

The ability to access data and rely on AI augmentation could result in a more robust supply chain and improve the ability to manage the supply chain during dynamic or tumultuous times.

Marketing Operations

Marketers rely on data and analytics to successfully market to their target audience. The tools exist to evaluate data quickly. With improved access to data, marketing teams can communicate more effectively with customers.

Retail Operations and Execution

AI augmentation affects the entire retail operation. Opening up access to data rather than parceling out limited data to departments or a few key staffers limits the operation from executing better performance.

Merchandising Operations and Management

As we’ve discussed, merchandisers and category managers face constraints. AI solutions can help them deal with those problems better and more efficiently.

Customer Service and Contact Center Management

Frontline retail staff would benefit from improved AI implementation too. Better information allows them to serve customers better.

Supply Chain Analytics

Evaluating the supply chain is an ongoing need. Retailers will always need to identify the strengths and weaknesses in their supply chain. Strengths and weaknesses change constantly owing to external factors. With AI augmentation, retailers have more tools to head off potential supply chain disasters. However, they must use this data effectively.

Demand Forecasting

Do your customers want what you're selling? Do they want as much as you’re ordering from suppliers? With improved AI-based demand forecasting, retailers can make more accurate assumptions about customer behaviors - and make their merchandising decisions accordingly.

Marketing Decision Support

As mentioned, marketers need good data to do good work. With data in hand, they can make better decisions and, importantly for them, justify their decisions based on the data’s reliability.

Merchandising Decision Support

Merchandisers can benefit from the support the AI tools offer for making decisions about merchandising. Today's retailers have access to more data about their customers than ever before. It makes sense to use that data to drive decision-making.

Pricing and Promotion Decision Support

Making decisions about promotions or pricing changes can more easily be accomplished with accessible data. Again, these decisions have financial fallout. Staffers want to be able to rely on data to make more sound decisions that not only affect the company but also affect their jobs.

Back Office Processes

AI augmentation drives overall operational improvement--even back-office processes. AI reduces errors and improves efficiency. That makes it worthy of investment from the point of view of many retailers.

Workforce Optimization

AI drives workforce optimization so retailers can make better decisions about their organizational efficiencies or inefficiencies.

Fulfillment Optimization

Using AI solutions to improve fulfillment optimization translates into more efficient and accurate merchandise handling. It also improves the fulfillment process for distribution employees.

Personalized Product Recommendations and Offers

Customers are used to personalization. They expect it. Even if your company isn’t investigating how to improve its personalization measures, rest assured, your competitors are.

Next-Gen Merchandising Solutions And Strategy Augmentation

Strategy and execution will necessarily be inextricably linked in the future of retail. With next-gen retail and CPG analytics collaboration tools, for example, both parties can simulate assortment strategies with any assortment and space constraints and category goals. Next-gen assortment merchandising tools that leverage the latest machine learning and operations research can operationalize the most effective assortment plan quickly and transparency needed for all stakeholders without the need for data scientists and business intelligence (BI) vs. data analytics teams involved.

Next-Gen AI tools include a strong simulation component, but the simulation tools are based on actual data. The AI can simulate merchandising decisions based on constraints, including customer loyalty/churn, demand transference and cannibalization, awareness of store-level space, assortment needs and goals, and much more.

These tools can also simulate scenarios based on supply chain constraints like those we witnessed during the pandemic. Supply chain issues need not bring retailers to their knees. Retailers have the opportunity to strategize better, using accurate data to make robust plans. Executing becomes easier in an ecosystem where data-driven planning has already been implemented.

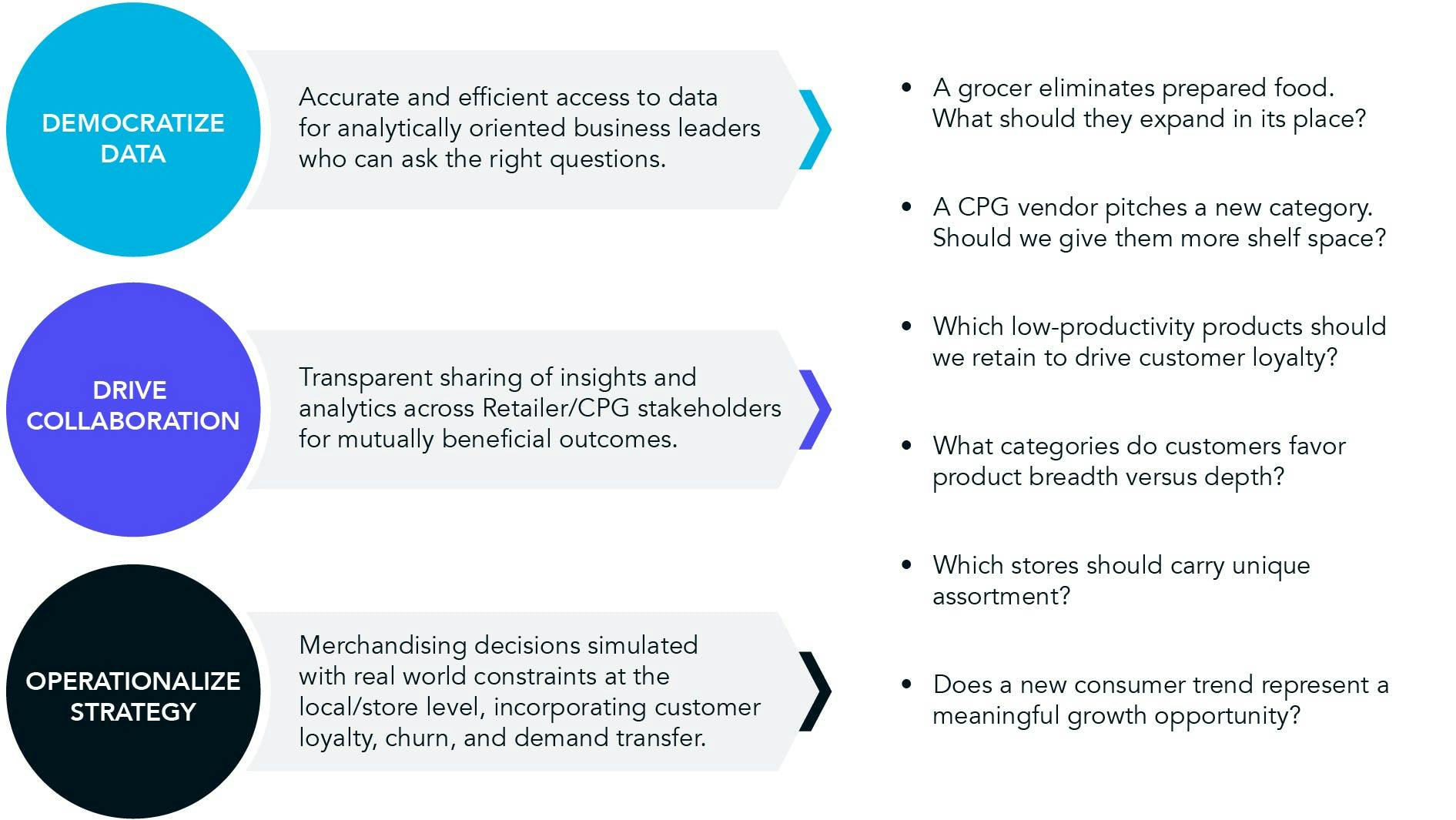

Next-Gen Solutions Democratize Data

Next-Gen solutions make data available and decision-making efficient. This means analytically oriented business leaders can use that data to make better-informed decisions without needing to wait for analysis from their BI and data science departments.

Driving Collaboration

Using these solutions, businesses can share information transparently and effectively. Any user can review how the assortment recommendations are devised by the solution - without a mathematics degree. This helps drive mutually beneficial outcomes. Demand forecasting becomes much easier when an organization can use data gathered from multiple branches alongside localized information.

Helping Retailers Operationalize Strategy

Retailers can simulate the outcomes of merchandising decisions at a local/store level or cluster of stores and take into account issues such as customer churn to get more accurate results. Instead of guessing based on historic trends, data-driven leaders can combine those historic trends with more recent metrics to create more accurate models.

Next-Gen Merchandising Solutions And Capabilities

Next-Gen merchandising solutions and capabilities rely on AI augmentation to improve decision-making. These solutions have many capabilities that make them powerful tools for retailers, including:

Granularity and Scale

Next-Gen AI augmentation tools allow retailers to integrate many personalized assortments across different customer segments, store formats, and channels while still--and this is key--having the ability to identify meaningful patterns and trends underscoring customer demand.

Demand Forecasting as an Underlying Driver

Customer demand at the category, item, and attribute levels is fundamental to assortment decisions. Next-Gen AI tools greatly enhance forecasting measures in terms of accuracy and efficiency.

Attribute-Based Assortment Planning

Retailers will be able to understand what attributes are driving current customer demand. For example, retailers can filter information according to product color, ingredients, brand, special features, benefits, etc., and understand which specific SKUs are the most in demand. This information is available in next-gen tools, making managing product selection and switching easier.

Intelligence-Based Store Clustering

Store clusters are not created based simply on sales volume. Rather, like-customer segments and volume-independent customer demand should be the focus. Retailers can rely on AI capabilities to base store clusters with greater accuracy.

Scenario Modeling and Comparisons

Retailers can rely on new automation tools to predict the impact of different assortment decisions on sales, inventory, and various customer metrics in real-time to facilitate decision-making. And, of course, the quality of those decisions should involve measurable improvement.

Customer Loyalty Insights, Beyond Consumer Decision

AI can now help retailers understand how loyal customers are to different SKUs. They can more effectively determine transferable demand and customer walk rate at the item level.

Optimization of Customer and Financial Metrics

Finally, retailers can leverage AI tools to promote optimization across their competing business decisions to improve considerations like space productivity and customer loyalty.

Next-Gen Merchandising Solutions Foster New Cultural Change

With the democratization of data within a retail organization or ecosystem and better design of user interfaces comes a greater ability to leverage Next-Gen tools. Both technical and non-technical employees will be able to access and use these tools to inform their decisions. This will change organizational culture as analytically oriented business teams, and leaders can begin to ask the right questions.

The Next-Gen AI tools' capabilities address current problems retailers face and provide real solutions. As we’ve discussed, these tools have numerous applications throughout the retail-supplier ecosystem. These tools drive better performance at the local level as well as at the top-tier organizational level.

In any company, culture is about “how things get done.” Next-Gen solutions allow humans to do what humans are good at, applying intuition, creativity, and strategy design.

Next-Gen merchandising solutions are decision support systems. They move us from an old world focused on automation to a new world focused on augmentation, from a process-driven culture to a shopper-centric driven culture, as illustrated below:

It’s not only C-suite office occupants that can leverage these tools to improve their performance. Employees at the local level can tap into useful data to make better decisions too. What drives these better decisions? In short, it's AI’s ability to transmit real-time data quickly. Sharing data quickly helps reduce the risk of human error from manual data collection. When retailers can share data more accurately between stores, this reduces the likelihood of evaluation errors and helps leaders take advantage of having access to a wider range of metrics.

Next-Gen merchandising offers data collection and sharing with:

- Speed

- Scale

- Accuracy

Today, even smaller retailers can take advantage of customer data at a chain and store-level thanks to Next-Gen tools. There's no need for a retailer to be a data scientist or analytics expert to use these systems, thanks to their simple user interfaces. The democratization of analytics and merchandising means anyone can collect, analyze and understand consumer behavior and make better merchandising and category management decisions.

Conclusion:

What Next-Gen Merchandising Solutions Will Offer

Next-gen merchandising solutions have much to offer with their AI functionality that considers assortment and space constraints to arrive at the most optimal or optimized action to take. The ability to run multiple assortment strategy scenarios and refine each strategy to arrive at agreed-upon goals. They build on the current standard by moving from planning and automation to augmentation.

Retail buyers, category management professionals, and assortment planners all need to manage SKU performance by juggling questions around SKU rationalization: what I don’t want, but is there? SKU introduction: what is not there but needs to? And finally, space allocation & localization: what is the right allocation for each store?

Next-Gen merchandising solutions offer several features and benefits:

Rapid strategy design and quantification

Retailers and CPG suppliers can design and run strategies, simulate outcomes, quantify that assortment strategy and execute the optimal scenario with rapidity like never before.

Generate prescriptive actions

Next-Gen merchandising solutions offer the “best next action” to take based on assortment datasets, goals and constraints entered. These tools understand the uniqueness factor, that is, SKU substitutability and value to customers (“walk rate”), as well as the economic performance factor, that is, what is the total and local financial contribution at sales per week, per store level.

Ease of use

Another advantage of today’s next-gen AI tools is that you don’t have to be an IT or analytical guru to understand and use them. These are democratized tools that even non-technical users can use to make analytically robust decisions.

Goal focused

AI models are not emotional; they do not have built-in human biases from experience. They use data to generate recommendations, so retailers and CPG suppliers can reach their category goals faster and better.

The adoption of AI technology can solve many of the category management problems. It’s not merely a disconnection from what customers want or need. There’s also a disconnect between retailers and suppliers that prevents them from collaborating to achieve shared goals, such as making the supply chain more resilient to disruptions.

AI augmentation offers numerous opportunities to improve collaboration with the power of rapid scenario play, moving the joint business planning process (JPB) to a more “live and conversation” approach to merchandising planning. They make processing data faster, simpler, and more scalable with less room for human error.

Will your organization move forward to implement new AI solutions or continue to rely on broken processes for merchandising and category management? What is clear is that these new tools won’t merely produce a seachange for merchandisers and category managers. They can positively impact every aspect of company culture: from shoppers to operations to back-office and supply chains. Few investments promise tremendous returns for retailers. The only question is how long your company can wait to use these next-gen solutions for category management augmentation.